Events Under the Spotlight

Polygon’s Blockchain Hard-Forked

Polygon (Previously Matic) found a vulnerability in the recently verified smart contracts. The team immediately introduced a fix coordinating with validators. No funds were lost in this upgrade.

Vulcan Forged Game Hacked, Crypto Assets Worth $140 Million Stolen

Vulcan Forged, a multi-chain NFT marketplace and blockchain game studio, became victim of the hack which affected 148 user wallets.

The funds from the affected user’s wallet were transferred-out. The affected users would be compensated from the Vulcan treasury.

Crypto Exchange AscendEX Hacked, Losses Estimated at $77M

AscendEX, a crypto exchange, notified the community in an official announcement that the internal audit found several ERC-20, Polygon (Matic) and BSC tokens were transferred from the exchange’s hot wallets and the cold wallets are not affected by the hack.

Total loss is $77.7 Million ($60 Million on Ethereum, $9.2 Million on BSC and $8.5 on Polygon).

Critical Vulnerability spotted in Gelato

Gelato, an automated smart contract execution platform on Ethereum, alerted the users of a critical vulnerability in a G-UNI router on Sorbet Finance. The vulnerability only affects who interacted with Sorbet Finance. Currently no funds are lost.

The project is working with Samczsun, a white hat hacker for the recovery of potentially vulnerable funds to move them to a secure escrow contract.

Solana Price Suffers as it Goes Under Another Attack

Solana suffered a DDoS attack that jammed the network and delayed transactions. The blockchain had suffered attacks multiple times before which has sparked the discussion around the efficiency of the Solana blockchain and comparison with Polkadot.

To the Numerophiles out there 🔢

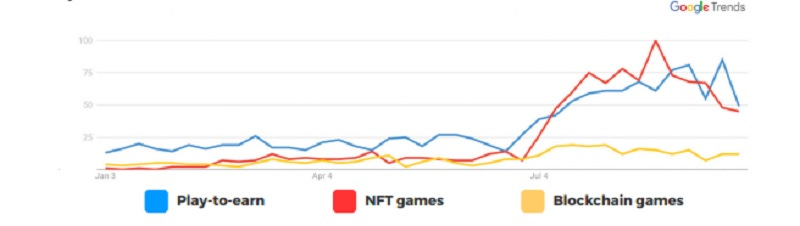

NFT games generated $2.32B in Q3: Blockchain Game Alliance.

Google Trends shows the growth of blockchain gaming in recent months. (Image Credit: Blockchain Game Alliance)

More From the Editor’s Desk

What a roller coaster ride cryptocurrency market saw in 2021!

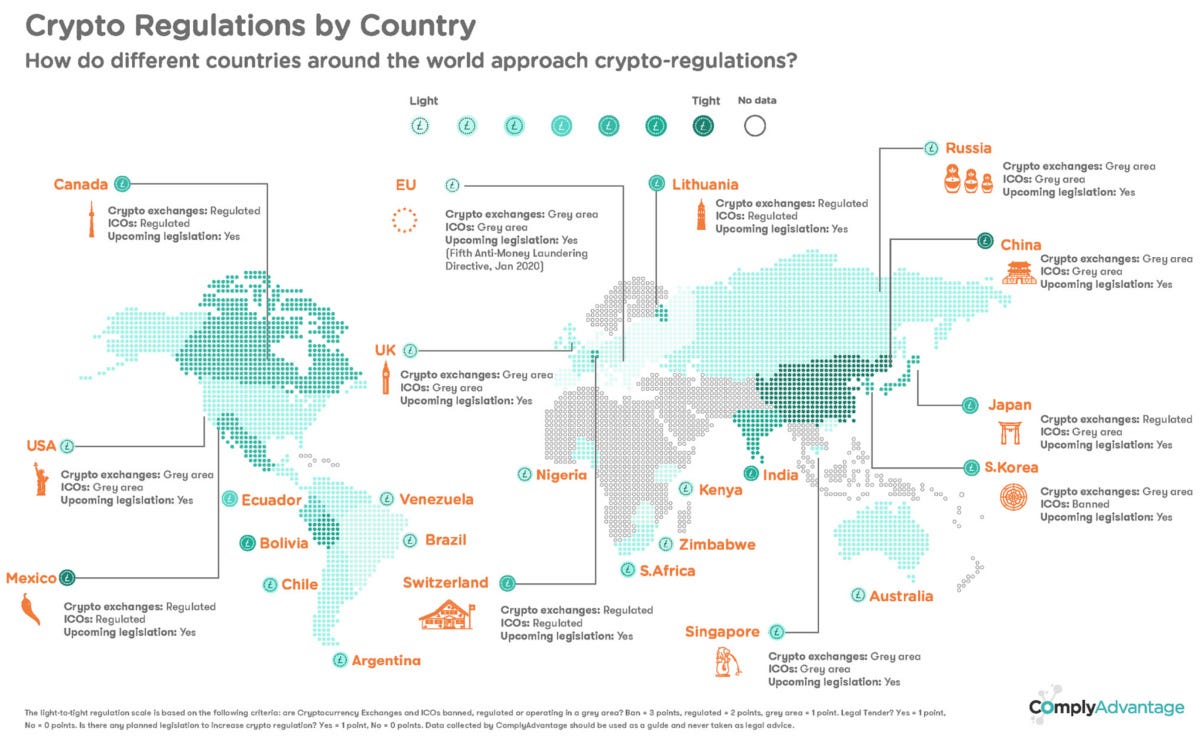

After scaling the highs of April to the lows of May & July, cryptocurrency market has seen it all this year. The Bitcoin ETFs was a watershed moment in the crypto industry so was China banning cryptocurrencies in the country.

Also, the El Salvador’s disruptive move to adopt Bitcoin as legal tender and the debut of eNiara in Nigeria. All these events of 2021 have made a profound impact on the market, and its effect could well define the investment trends in 2022.

Here’s the 5 biggest trends that could define the crypto market and could well be a game-changer in how this market operates.

Word on the Block

Versus Series

Web 1.0 🆚 Web 2.0 🆚 Web 3.0..!

Catch out the Key differences between various significant terminologies in the Blockchain.