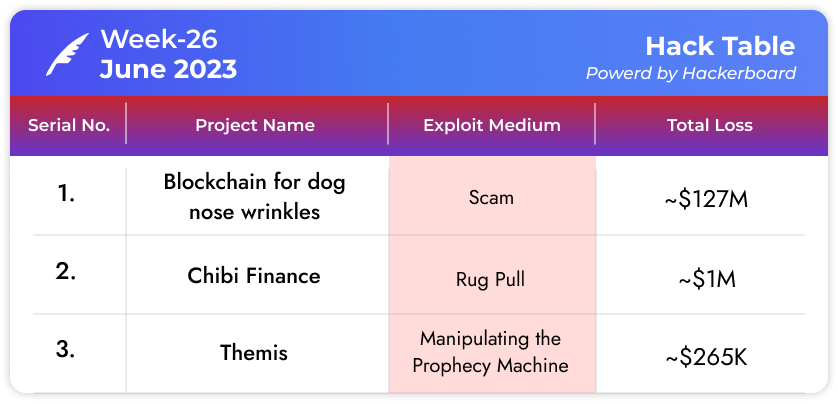

In brief⚡

Sniffing Out ~$127M Trouble: Investors Left High and Dry with Dog Nose Wrinkles Blockchain Scam.

Chibi Finance Pulls a Sneaky Rug on Investors, Leaves Them $1M Short and Stunned.

Themis Protocol Suffers $256K Setback Due to Oracle Implementation Flaw.

Hacks and Scams⚠️

Blockchain for Dog Nose Wrinkles

Amount of Loss: ~ $127M

Analysis

A South Korean blockchain enterprise, “Blockchain for Dog Nose Wrinkles”, enticed investors with an innovative blockchain app designed to identify canines through their distinctive nasal folds.

Project promised up to 150% returns on investment in 100 days, raising about 166.4 billion South Korean won — or about $127 million — from 22,000 people.

The investigation exposed a heart-wrenching truth—the acclaimed dog nose wrinkle reader was a sham. This Ponzi scheme left investors reeling, losing over $100 million.

Swift justice ensued as South Korean authorities apprehended three and charged 64 others with the alleged fraud. Let this cautionary tale remind us to stay wary amidst the allure of web3 wonders.

Chibi Finance

Amount of Loss: ~ $1M

Analysis

Chibi Finance hack that left cryptocurrency investors worth approximately ~$1 million drained.

With cunning precision, exploiters converted the stolen funds cleverly into around 555 ETH, which were swiftly transferred from Arbitrum to Ethereum.

Exploiters have already transferred funds into Tornado Cash.

Themis Protocol

Amount of Loss: ~ $265K

Analysis

Themis Protocol suffered a loss of ~$265K.

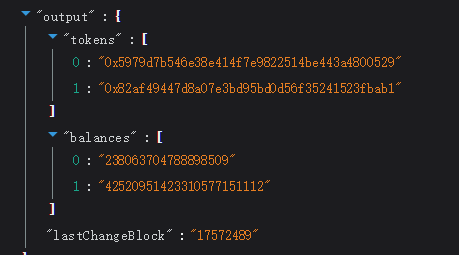

This incident occurred due to a flaw in the project's Oracle implementation, which proved to be their Achilles' heel.

The cunning attacker cleverly utilized a substantial amount of WETH (wrapped Ether) to swap for wstETH (wrapped staked Ether) before engaging in borrowing activities.

The attacker then masterfully manipulated the oracle, deceiving it into providing an incorrect price. This shrewd manoeuvre enabled the attacker to borrow a staggering 317 WETH while possessing only 55 WETH.

The plot thickens as the tale unfolds further. The exploit hinged on a pivotal moment when the getAssetPrice function interacted with the Balancer: Vault.getPoolTokens function. This interaction led to a drastic alteration in the amounts of wstETH and ETH, transforming them from the expected ratio of 2,423:2,796 to an extraordinary ratio of 0.238:42,520. This cunning manipulation succeeded in deceiving the oracle, contributing to the overall success of the exploit.

Explore the Depths of Knowledge: Research Papers & Blogs🔖

What is a Reentrancy attack? — Let’s understand them and prevent them.

If you have already heard about the nonReentrant() modifier, keep reading because you are about to discover a few lines below the globalNonReentrant() modifier and the checks-effects-interactions pattern.

Unlocking Fantom Blockchain’s Potential: A Comprehensive Guide to Fantom Security Audits

Fantom, a high-performing Layer 1 blockchain, has recently become a hub for DeFi due to its scalability and cost-effective transaction processing. With an impressive increase of 163% in the average block size in 2022, Fantom is certainly making its mark in the blockchain sphere.

Web3 Community Spotlight🔦

Web3 Innovation🌠

📢 Join the Beta Launch of QuillCheck! - Your First Line of Defence Against DeFi Fraud, Rug Pulls and Honeypots!

💥 Be part of the elite few invited to our exclusive beta launch! Gain early access to QuillCheck and wield the power of secure DeFi investing like never before.

✅ Join our Discord Server: https://discord.gg/mNhxJcSpyh