This Week in Hacks

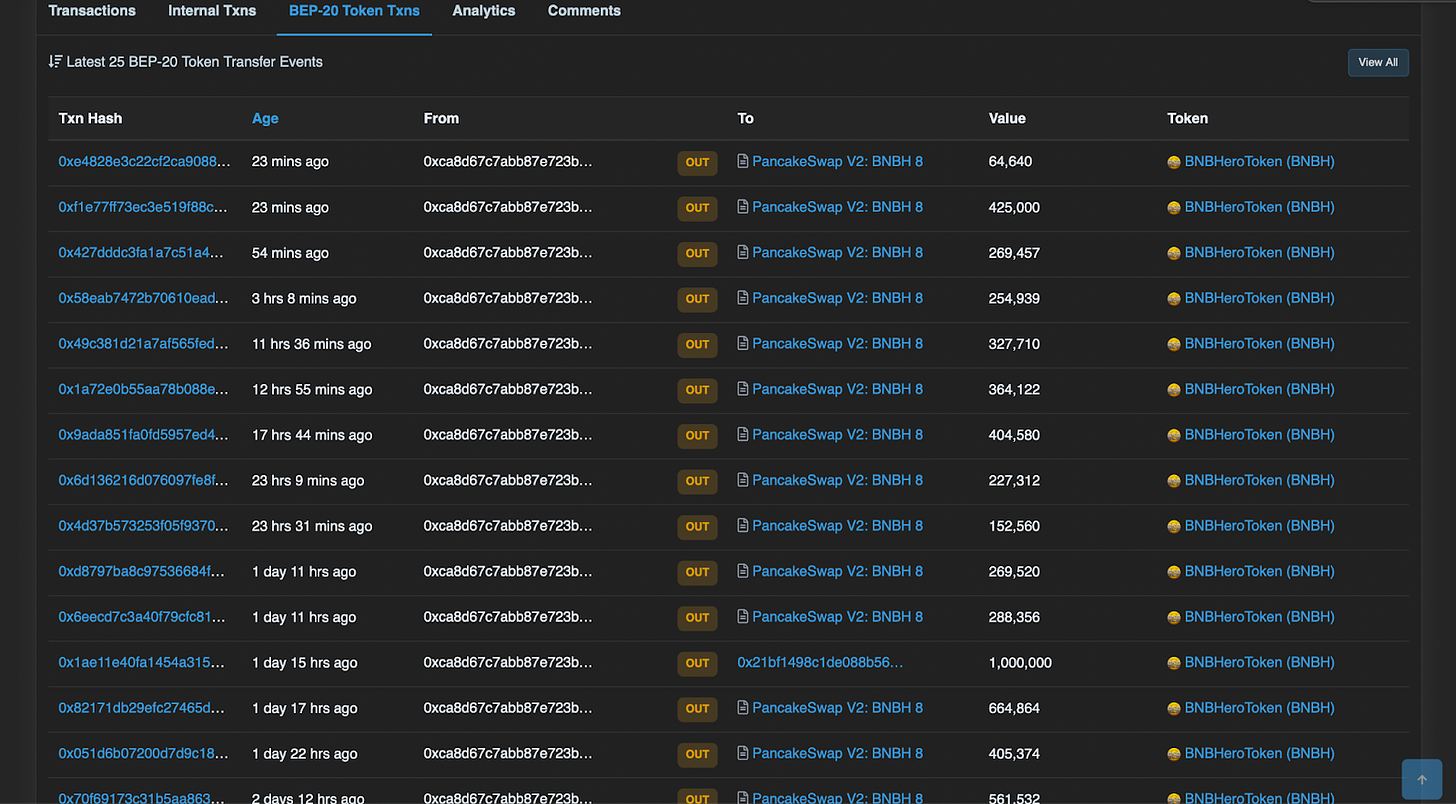

BBHeroes soft rugged and dumped the liquidity for $2 Million.

PizzaPro Finance, an EOS based payment gateway suffered an exploit

In this hack, an attacker exploited an overflow vulnerability in eCurve to mint infinite Tripool tokens and deposit as collateral in the Pizza platform. $5 Million worth of tokens were lost in this heist.

Autobot DeFi (Fantom) scammed people by removing liquidity shortly after launching the farm.

A bug in Solana SPL, a crypto lending library of Solana was patched which could have put more than $2 Billion at risk, locked in various DeFi protocols on Solana blockchain.

Celsius Network, a crypto lending company’s CEO confirmed to have lost funds in the BadgerDAO exploit. According to the speculations on Twitter, the company would have lost over $50 Million in the hack.

BitMart experiences a Data Breach

BitMart, a centralised crypto exchange disclosed a data breach which affected ETH and BTC hot wallets of the exchange. The hackers stole cryptocurrencies worth $200 Million.

Other hot wallets remain undamaged. Withdrawals have been temporarily suspended.

BadgerDAO hacked for $120M

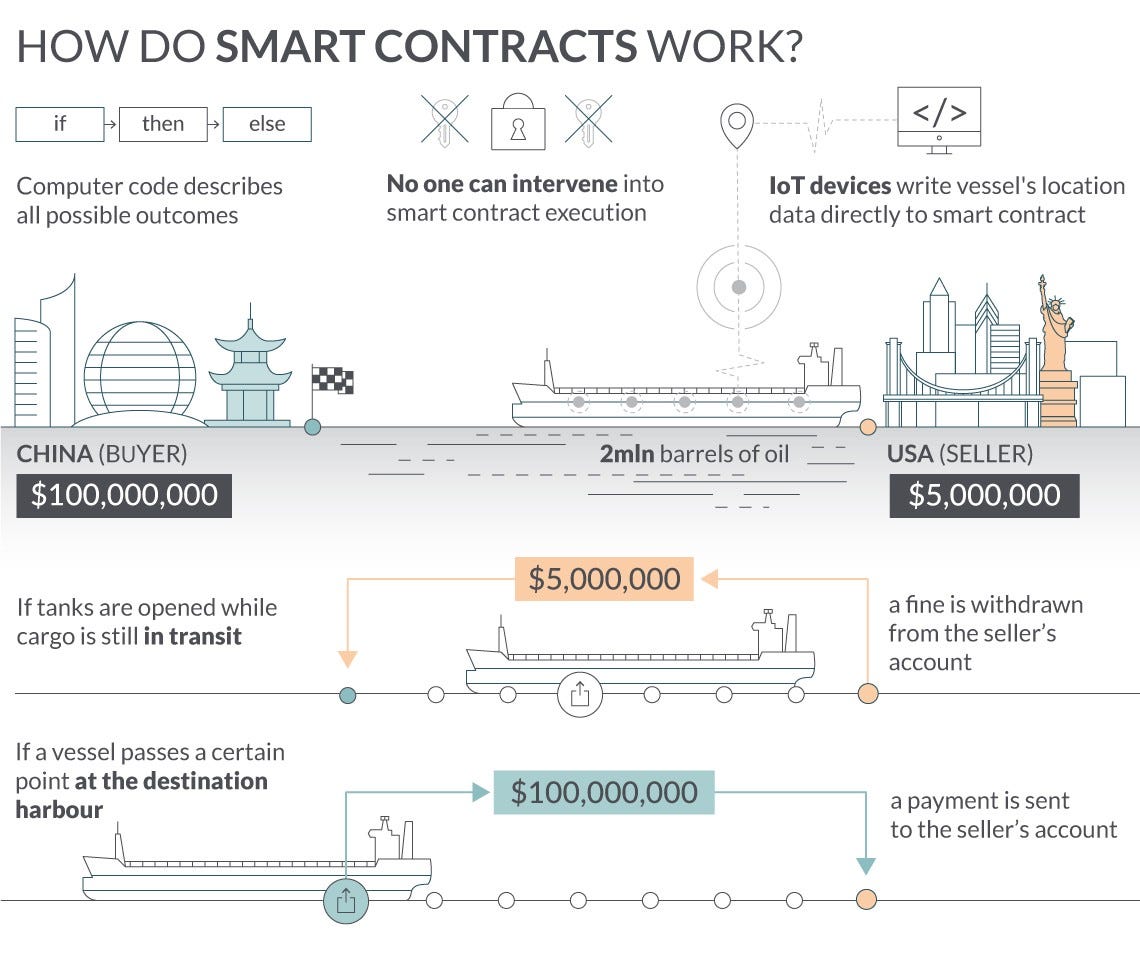

BadgerDAO, a DAO platform that allows BTC as a collateral, was hacked for $120 Million. The recent exploit led some users to approve malicious smart contracts and loss of funds.

The hackers exploited a vulnerability in the front-end of BadgerDAO’s website last week. All contracts have been paused at the time of writing.

To the Numerophiles out there 🔢

NFT sales hit $293 million over the past week.

Source: here

More From the Editor’s Desk

One fine day you got an out of the box idea to build a DeFi project. You have successfully developed the project and to save it from any external threat, you got it audited.

But still there’s a doubt quotient haunting you day-in & day-out about whether the audit done was up to the mark or not!

Hence, whether you are an enterprise owning the DeFi project (or) a smart contract auditor, there remains a certain scope of value addition in the smart contract’s audit.

According to a report in 2016, existing auditing standards are, for a larger part, reactive in nature, responding to particular needs instead of anticipating the needs. The consequence of this is that these standards are always lagging.

If you’re also amongst prominent stakeholders of Blockchain, checkout whether “Current Auditing standards can match up with your Blockchain use case or not?”.

Word on the Block

The term of the week from the pages of DeFi & NFT📚.

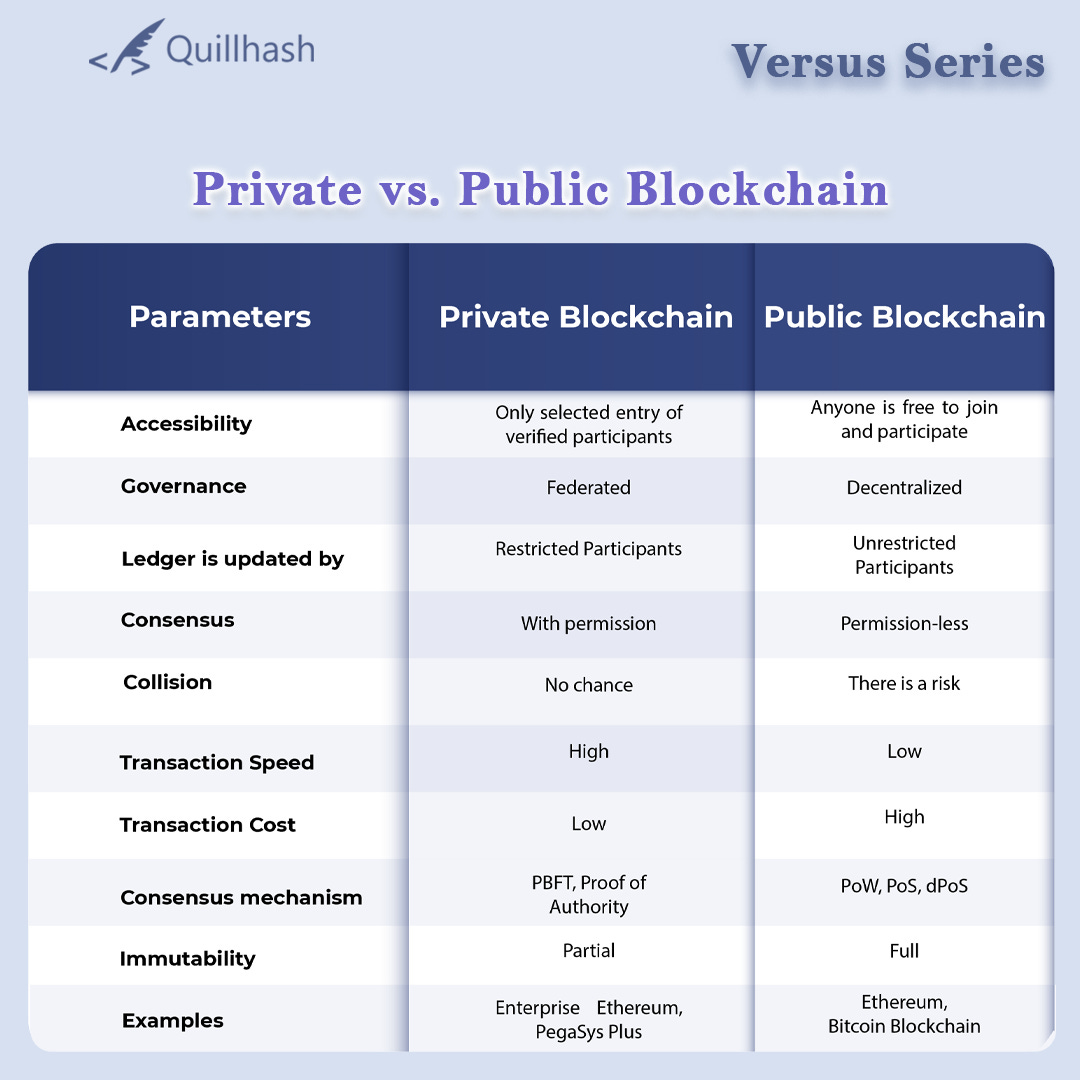

Versus Series

Private 🆚 Public Blockchain..!

Catch out the Key differences between various significant terminologies in the Blockchain🔠.