In brief ⚡

Ripple Co-founder's Personal Wallet Breached, $112M in XRP Allegedly Lost; Investigations Underway

Abracadabra Finance, a DeFi project, suffered an exploit confirmed by its team on Jan. 30, leading to a significant drop in the value of its digital assets.

Goledo Finance Negotiates with Hacker After $1.7 Million Cryptocurrency Breach

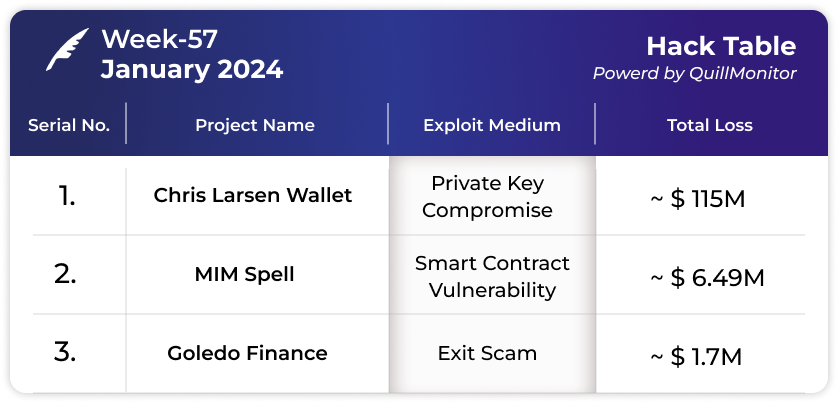

Hacks and Scams⚠️

Chris Larsen’s Private Wallet

Amount of Loss: ~ $115 M

Analysis

Ripple's XRP faced selling pressure due to news of an alleged hack, initially reported to have resulted in the loss of 213 million XRP coins (~$112 million).

Ripple co-founder Chris Larsen clarified that the breach affected his personal wallets, with Ripple's wallets and investors' funds remaining secure.

Prompt action was taken by Ripple, including identifying the issue, notifying exchanges to freeze affected addresses, and involving law enforcement agencies in the investigation.

Investigations revealed that most of the affected funds had been converted out of XRP. Significant efforts are underway to freeze the remaining funds and resolve the situation.

Despite the price drop below $0.50 and XRP slipping to the seventh spot by market cap, data showed increased high-value transactions on the network, indicating limited panic among significant investors.

MIM Spell

Amount of Loss: ~ $6.49M

Analysis

Abracadabra Finance, a DeFi project, suffered an exploit confirmed by its team on Jan. 30, leading to a significant drop in the value of its digital assets.

The exploit involved certain Ethereum cauldrons, causing the project's stablecoin, Magic Internet Money (MIM), to deviate from its $1 peg, dropping to as low as $0.77 before recovering to $0.92.

The team stated that the DAO treasury would endeavour to assist the stablecoin in regaining its peg by buying back MIM from the market to burn it.

The protocol's SPELL reward token also experienced a decline, dropping 2.43% to $0.00051.

The security incident resulted in a rapid decrease in the total value of assets locked on the platform, falling by approximately $23 million to $139 million according to DeFillama data, although Abracadabra's website pegged the total outflow at $10.3 million and its total value locked (TVL) at $150 million.

Goledo Finance

Amount of Loss: ~ $1.7M

Analysis

Goledo Finance experienced a significant security breach in its lending and borrowing market on January 28, leading to the identification of irregularities within its lending pool.

The company promptly suspended its lending pool to prevent further unauthorized access.

The hacker responsible for the breach, allegedly involving $1.7 million, reached out to initiate negotiations with Goledo Finance.

Goledo Finance has taken a firm stance, demanding the full return of the stolen tokens and offering a reward and immunity from legal action in exchange.

Collaborative efforts with centralized exchanges and local authorities are underway to freeze the hacker's accounts and recover the stolen funds, but the impact on GOL's market value remains significant, with a 35% decrease observed.

Explore the Depths of Knowledge: Research Papers, Blogs and Tweets🔖

Tweets

GitHub Repos

Articles

A quick reddit post on how I think about choosing guardians for social recovery and multisig wallets

Web3 Community Spotlight🔦

Thanks for reading HashingBits! Share a summary of our newsletter on your social media platforms, tag us, and use the #AwareToEarn hashtag, and you could win 10 USDT as a reward! Help us build a safer Web3 ecosystem and have a chance to earn rewards and support our work.